per capita taxes by state

The highest state and local property tax collections per capita are found in the District of Columbia 3496 followed by New Hampshire 3307 New Jersey 3276 Connecticut 3020 New York 2902 and Vermont 2670. In Mississippi the nominal per capita income is 1155 lower than the corresponding real per capita income in the state 42129.

Average Tax Return In Usa By State And Federal Revenue From Income Taxes Per Capita In Each State Infographic Tax Refund Tax Return Income Tax

ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000.

. Real per capita income. The five states with the highest tax collections per capita are New York 8957. The District of Columbia though recorded a GDP per capita figure far higher than any US.

Still residents of DC. New York 2877 the District of Columbia 2815 Maryland 2390 Connecticut 2227 Massachusetts 2145 and California 2137 came in with the top five collections per capita. With the exception of Taxpayer ROI all of the columns in the table above depict the relative rank of that state where a rank of 1 represents the lowest total taxes paid per capita and the best government services respectively.

Main Features of State Tax Systems. In both 2020 and in 2021 as well as the GDP change and GDP per capita for those two years. This US destination is among the ones with the worst tax burden by state.

1 Best Per Capita includes the population aged 18 and older. Nominal per capita income. The average resident of a blue state pays 9438 in federal taxes while the average resident of a red state pays 6591.

For example in Virginia people on average contribute 10571 in federal tax revenue but benefit from 20872 in federal outlays. The amount of federal taxes paid minus federal spending received per person by state can be found here. South Carolina and Arizona collect the least in state and local excise taxes per capita 33651 and 33729 respectively followed by Nebraska 352 and Idaho 357.

The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value. Nominal per capita income. Of the states that tax wage income the lowest collections per capita in fiscal year 2018 were in North Dakota 485 New Mexico 599 Mississippi 622 Arizona 635 and Louisiana.

0 tied - the lowest Property tax collections per capita. The five states with the highest tax collections per capita are New York 9829 Connecticut 8494 North Dakota 7611 New Jersey 7423 and Hawaii 7332. Nominal per capita income.

443 6 490 1 342 25 2. Real per capita income. State and Local Tax Revenue Per Capita.

If both do so it is shared 5050. Pay the highest property taxes per capita of 3500. State in 2021 at 226861.

This is a table of the total federal tax revenue by state federal district and territory collected by the US. Download dqs_table_79apdf 13371 KB Download dqs_table_79axls 445 KB August 26 2021. See more graphs about.

State Revenues and Expenditures. Real per capita income. In the list below you can find the annual Nominal GDP of each state and territory of the US.

The highest state and local property tax collections per capita are found in the District of Columbia 3740 followed by New Jersey 3378 New Hampshire 3362 Connecticut 3107 New York 3025 and. Of most products eg Washingtons BO tax per Census Bureau classifications. 255 34 318 8 697 1 3.

The lowest collections per capita are found in Alabama 582 Oklahoma 730 Arkansas 740 New Mexico 792 and. This amount is significantly larger than the 582 paid in property taxes per capita in Alabama. State the District of Columbia and Puerto RicoThe figure includes all Individual federal taxes and Corporate Federal Taxes income taxes payroll taxes.

Gross Collections indicates the total federal tax revenue collected by the IRS from each US. Tennessee 37 and New Hampshire 49 tax investment income but not wage income making them the states with the lowest individual income tax collections per. 531 2 249 22 333 27 5.

Total Sales Taxes Table 10. 211 rows Total taxes thousands Population Per capita State Alabama. Federal Tax Components and Credits by State.

Virginia Kentucky and New Mexico top the charts as the top three getting the most money back. The five states with the lowest tax collections per capita are Tennessee 3286 Alabama 3527 South Carolina 3705 Mississippi 3767 and Arizona 3824. The Union County Commissioners eliminated per capita taxes several years ago.

Income tax collections per capita. Vermont has the highest state and local excise tax collections per capita 1075 followed by Nevada 993 and Hawaii 928. 1498 25th lowest General sales tax.

51 rows State. It can be levied by a municipality andor school district. In the past state and local taxing authorities have turned to excise.

What is difference between an ACT 511 and ACT 679 Per Capita Tax. All state local county and school district taxes including property taxes. 50 rows Real per capita income.

New Jersey has the highest property tax rates on owner-occupied homes of 247. Nominal per capita income. Tennessee 36 and New Hampshire 78 taxed investment income but not wage income making them the states with the lowest individual income tax collections per capita.

2 Specific taxes upon particular items such as gasoline alcoholic beverages tobacco products and public utilities. Per Capita State and Local Sales Tax Collections Fiscal Year 2000 General Sales Taxes 1 Selective Sales Taxes 2. On average state and local governments collected 1675 per capita in property taxes nationwide in FY 2018 but collections vary widely from state to state.

548 1 251 21 343 24 4. Total Tax Burden Property Tax Burden Individual Income Tax Burden Total Sales Excise Tax Burden 1. State Revenues and Expenditures.

ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be.

15 Reasons Why Anyone Who Hates Iowa Can Just Shut Up Life Map States In America United States Map

Americans Are Migrating To Low Tax States Native American Map American History Timeline United States Map

Ranking Unemployment Insurance Taxes On The 2019 State Business Tax Climate Index Legal Marketing Local Marketing Business Tax

Us States With The Highest And Lowest Per Capita State Income Taxes Map American History Timeline Mapping Software

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

2016 Property Taxes Per Capita State And Local Property Tax Buying A New Home Home Buying

Improving Lives Through Smart Tax Policy Income Tax Local Marketing Tax Lawyer

Here Are The Best And Worst States For Taxes Gas Tax Healthcare Costs Better Healthcare

Mapsontheweb Infographic Map Map Sales Tax

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

State Income Tax Collections Per Capita Map Graphing Cartography

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Map

West Virginia Has Some Of The Lowest Property Taxes In The Nation As Indicated In White On This Map Property Tax Map Us Map

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

The States With The Highest Corporate Income Tax Collections Per Capita Are New Hampshire Massachusetts California Alaska An Income Tax Business Tax Income

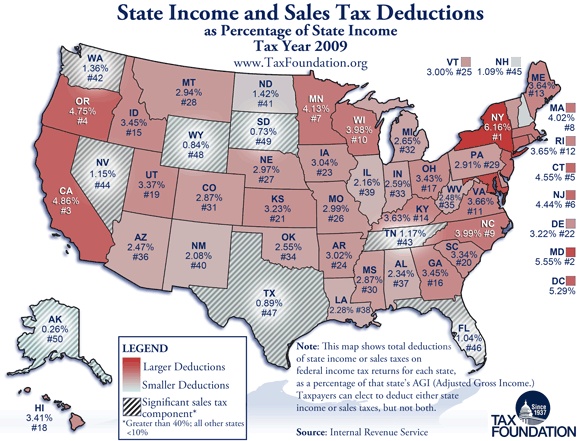

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Retirement Strategies